The $18 Million Lesson in Influence, Negotiation & Reinvention

You’ve heard the name. You’ve heard the stories. But who is Rick Otton, really?

Hear Rick in his own words — the Dallas fluke, the cardboard box that became the We Buy Houses Global brand, the $18M fine that made headlines, and the lessons in persuasion and resilience that followed.

Rick Otton is a pioneer in innovative and creative structured real estate and one of the world’s most revolutionary transaction engineers. For more than three decades, he has challenged the status quo, turning setbacks into springboards and ordinary transactions into extraordinary opportunities. His story is one of resilience, reinvention, and relentless curiosity — a journey that has left fingerprints on property markets, business strategies, and even national legislation.

Early Lessons: Body Language & Breaking New Ground

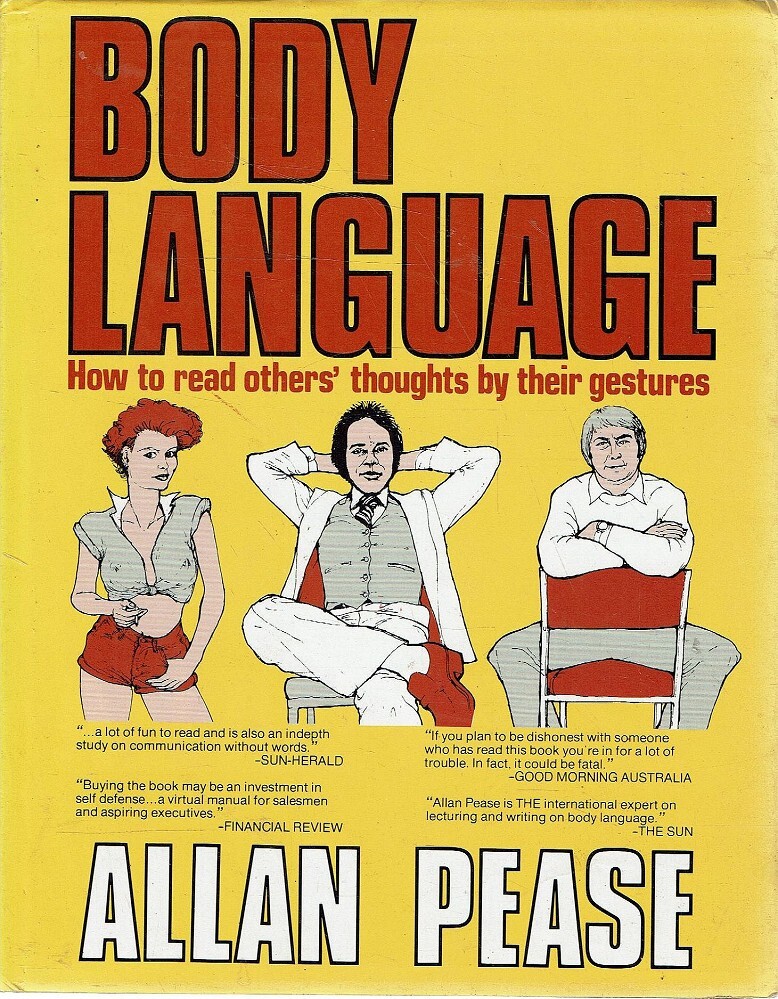

Rick’s entrepreneurial journey began in the late 1970s, when as a teenager he worked with Alan Pease, the man who introduced body language to the world. At the time, the subject was considered “voodoo science.” Publishers refused to touch it.

Yet Rick watched as Alan self-published and sold millions of copies worldwide. The lesson was clear: when you’re ahead of your time, rejection comes first, recognition comes later.

That early exposure taught Rick that 7% of communication is words, 38% is tone, and 55% is body language or subliminal sciences. More importantly, he saw how long it can take for new ideas to be accepted. Decades later, he would draw on this same principle when introducing his own disruptive property strategies to skeptical markets.

The Dallas Fluke That Became a Global Brand

By the late 1980s, Rick had relocated to Dallas, Texas, during the collapse of the savings-and-loan industry. With banks failing and property values plummeting, he stumbled into his first house deal. The seller wanted $86,000; Rick had $1,000. Instead of walking away, he structured a $1,000-a-month payment plan — unknowingly creating a system that would change his life.

When 40 other people showed up later wanting the same house from Rick for $1,500, Rick realized he wasn’t short of opportunities — he was short 39 houses. Grabbing a cardboard box, he scrawled “We Buy Houses” with a phone number and stuck it on a tree. That moment birthed a phrase that became a global brand.

Revolutionary Strategies, Reluctant Markets

Rick’s methods — seller finance, various types of options, and structured transactions — were met with resistance. In the early days, industry gatekeepers dismissed them as “impossible” or “illegal.” But Rick remembered Alan Pease’s words: “It takes twenty years for new ideas to gain traction.” He persisted.

By the early 2000s, he had taken We Buy Houses to Australia and the UK. There, too, critics scoffed. Yet after the 2008 global financial crisis, those same strategies gained mainstream acceptance. Today, what was once considered radical is now routine in most parts of the world

Fingerprints on the Jar

Rick Otton’s unique business insights have seen him pivot — from performing the act to producing it, from property to beyond. For those familiar with his work, his name may not always be stamped boldly across the lid, but his fingerprints are unmistakably all over the jar. His influence has quietly shaped property markets, business strategies, and even legislative frameworks, leaving a legacy that is both seen and felt.

Ahead of the Curve: Influence on Policy

In 2007, as the GFC unfolded, mortgage insurers and bankers sought Rick’s perspective on foreclosures and defaults. He proposed a radical idea: allow “anyone to pay anyone else’s loan” so that debts could be kept performing rather than collapsing into delinquency. Four years later, reforms to the Australian Credit Code 2010-11 introduced provisions almost identical to his suggestion — a testament to how Rick’s thinking often outpaced regulators themselves.

The Book That Shook a Nation

Rick is perhaps best known for his book How to Buy a House for a Dollar. Written deliberately in plain, conversational language, designed to be finished in a single flight, it became both a bestseller and a lightning rod. The fluorescent cover grabbed attention, the stories inside inspired thousands, and the title provoked outrage.

In earlier days a civil fine long resolved — $18 million — not for the strategies, but for marketing claims judged to be “misleading.” Rick has always been candid about the lesson: “In a perfect world, we’d all read the back of the bus ticket. I didn’t. And I learned the hard way.”

The Rick Otton Experience

What could have ended a career instead amplified Rick’s persona as the “Cheeky Daredevil” — a speaker who combines stagecraft with substance, storytelling with strategy. Audiences from Sydney to London have seen him make complex concepts simple, challenge entrenched thinking, and show people how to transact deals that seem impossible.

Rick’s events became legendary as part education, part theatre. His mix of humour, analogies, and “Rickisms” gave students both technical tools and the confidence to use them. From the “buddy system” to the “what’s your second choice?” line, his unique language patterns and understanding of brain science provided a shorthand for a way of thinking about deals, persuasion, and possibility.

Legacy & Ongoing Influence

Today, Rick Otton is more than a property educator. He is a strategist, mentor, and serial entreprenuer whose legacy stretches from living-room deals in Dallas to lecture halls in London and Sydney, and now into digital platforms where his insights continue to shape new generations.

His journey proves that resilience, creativity, and revolutionary thinking can rewrite the rules of business and life. For some, Rick’s story is a warning; for others, it’s a spark and sign of hope.. But for anyone looking closely, it’s a reminder that the world doesn’t move forward by following instructions — it moves forward when someone dares to scribble a new idea on the side of a cardboard box. As Rick says,“ Things don’t change, people change things.”

✍️ Fast Facts & Milestones

- 1978 – Worked with Alan Pease, co-creator of body language movement.

- 1989 – First Dallas deal → We Buy Houses brand born.

- 1990s–2000s – Expanded strategies into Australia the UK, Europe and Asia

- 2007 – GFC: consulted with banks/insurers; ideas echoed in later legislation.

- 2011 – How to Buy a House for a Dollar published → bestseller & controversy.

- Today – Speaker, mentor, and digital educator, influencing new generations of investors and entrepreneurs.

🚀 Work With Rick

Want Rick to speak, consult, or collaborate?

- Book Rick for podcasts & media interviews

- Invite Rick to speak at your event

- Connect for strategic partnerships